The world of Forex trading is fast-paced and ever-changing, with new platforms emerging all the time. For traders, whether novices or seasoned pros, choosing a reliable trading platform can be the difference between success and failure. In this article, we’ll explore the best forex trading platforms of 2023 to help you make an informed choice.

With so many options available, it’s crucial to understand what features to look for, how each platform operates, and which ones stand out in the crowded marketplace. Let’s dive in!

What to Look for in a Forex Trading Platform

Before we jump into our top picks, let’s discuss the key features that make a Forex trading platform worth your time and investment.

1. User-Friendly Interface

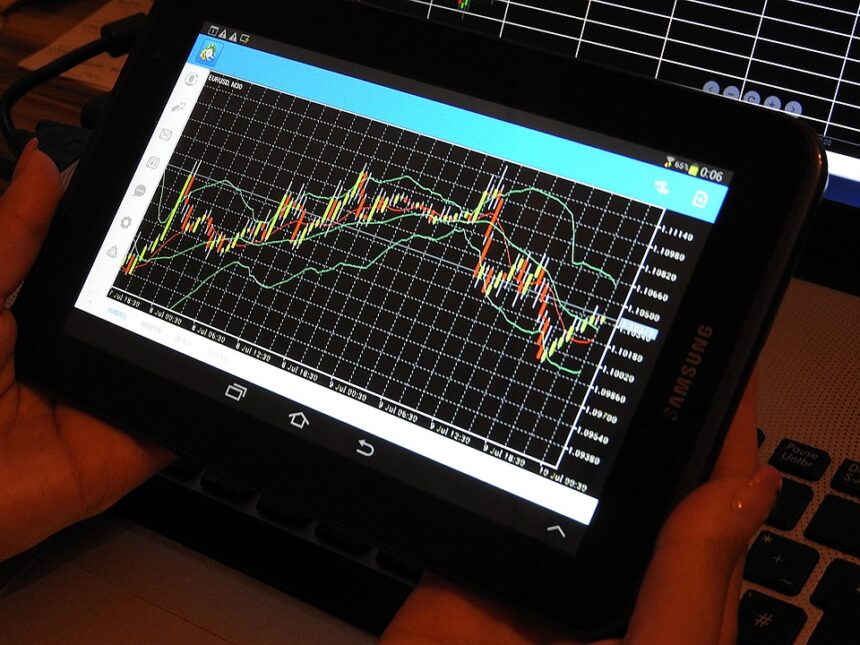

A clean, intuitive interface is vital for both beginners and experienced traders. Look for platforms that offer easy navigation and clear charting tools.

2. Variety of Trading Instruments

You’ll want a platform that provides access to a wide range of currency pairs, commodities, and indices.

3. Low Fees and Spreads

The cost of trading can significantly impact your profits. Consider platforms with competitive spreads and commissions.

4. Regulatory Compliance

Ensure that the platform is regulated by recognized authorities. This adds a layer of safety to your trading experience.

5. Strong Customer Support

Trading issues can arise at any time. Choose a platform with responsive customer support to get help when you need it most.

6. Educational Resources

Platforms that offer educational tools and resources can help you grow as a trader.

Top 10 Forex Trading Platforms for 2023

Now that you know what to look for, here are our picks for the best forex trading platforms in 2023.

1. MetaTrader 4 (MT4)

Overview:

MetaTrader 4 remains one of the most popular platforms among Forex traders. Its user-friendly interface and robust trading tools make it ideal for all skill levels.

Key Features:

- Extensive charting capabilities

- Automated trading through Expert Advisors

- A large community of traders and support resources

2. MetaTrader 5 (MT5)

Overview:

The successor to MT4, MetaTrader 5, takes trading a step further with advanced features.

Key Features:

- More timeframes and analytical tools

- Access to stocks and futures

- Built-in economic calendar

3. eToro

Overview:

eToro is leading the charge in social trading, allowing users to copy trades from successful investors.

Key Features:

- User-friendly interface

- Integrated social trading platform

- Various markets beyond Forex

4. Forex.com

Overview:

Forex.com is well-regarded for its robust trading tools and educational resources, catering to both beginners and pros.

Key Features:

- Excellent trading research

- Comprehensive educational resources

- High level of regulatory compliance

5. Oanda

Overview:

Oanda is celebrated for its reliable execution and innovative tools, making it a favorite among serious traders.

Key Features:

- Flexible leverage options

- Extensive historical data for analysis

- Powerful charting tools

6. IG Markets

Overview:

IG Markets offers a well-rounded trading experience with numerous instruments and excellent customer support.

Key Features:

- Competitive spreads

- Access to a variety of markets

- Educational webinars for traders

7. Interactive Brokers

Overview:

Interactive Brokers caters to more sophisticated traders with advanced trading tools and low fees.

Key Features:

- Extensive asset selection

- Advanced trading platform

- Low-cost trading fees

8. Thinkorswim (by TD Ameritrade)

Overview:

Thinkorswim is a powerful trading platform that provides advanced tools and analytics.

Key Features:

- Excellent research and charting capabilities

- Variety of trading products

- Strong customer service

9. SaxoBank

Overview:

SaxoBank offers a premium trading experience with its sophisticated platform and broad market access.

Key Features:

- High-quality research and insight

- Exceptional trading tools

- Competitive spreads and commissions

10. Capital.com

Overview:

This platform excels in offering a wide range of educational resources and an intuitive trading interface.

Key Features:

- User-friendly design

- Variety of trading instruments

- Comprehensive educational materials

Tips for Choosing the Right Forex Trading Platform

Here are some practical tips to further empower your decision-making process:

- Try Before You Commit: Many platforms offer demo accounts. Use these to familiarize yourself with the interface before committing real money.

- Check Reviews: Look for real user reviews to gauge the platform’s reliability and performance.

- Understand the Fees: Always read the fine print regarding spreads, commissions, and withdrawal fees.

- Test Customer Support: Reach out to customer support with questions before signing up to evaluate their responsiveness and helpfulness.

Conclusion: Your Trading Journey Awaits

Choosing the right Forex trading platform is essential for your trading success. With the options listed in this article, you have a solid starting point to find the best fit for your trading style and needs.

Remember to assess your own trading goals, whether you’re focused on low fees, a variety of instruments, or advanced trading tools. Take your time to explore different platforms, utilize demo accounts, and familiarize yourself with their features.

Now that you’re equipped with the knowledge about the top 10 best forex trading platforms, it’s time to get started on your trading journey! Happy trading!